If you are running a small business, you may be considering offering health insurance as a benefit for your employees. Offering group health insurance can be a great way to encourage higher employee retention and greater job satisfaction.x

However, small businesses paid about 8% to 18% more than large companies for the same health insurance policies over the past decade. The average family health insurance premium has increased by 54% since 2009 and by 22% since 2014.

Why does this happen?

Health insurance providers will often charge different premiums to small employers based on the industry or the employer’s prior health claims.

This discrepancy can mean that both workers and small employers feel the financial squeeze. It also means that fewer small businesses can afford to offer group health insurance coverage to their teams.

How Much Does It Cost a Business To Offer Health Insurance?

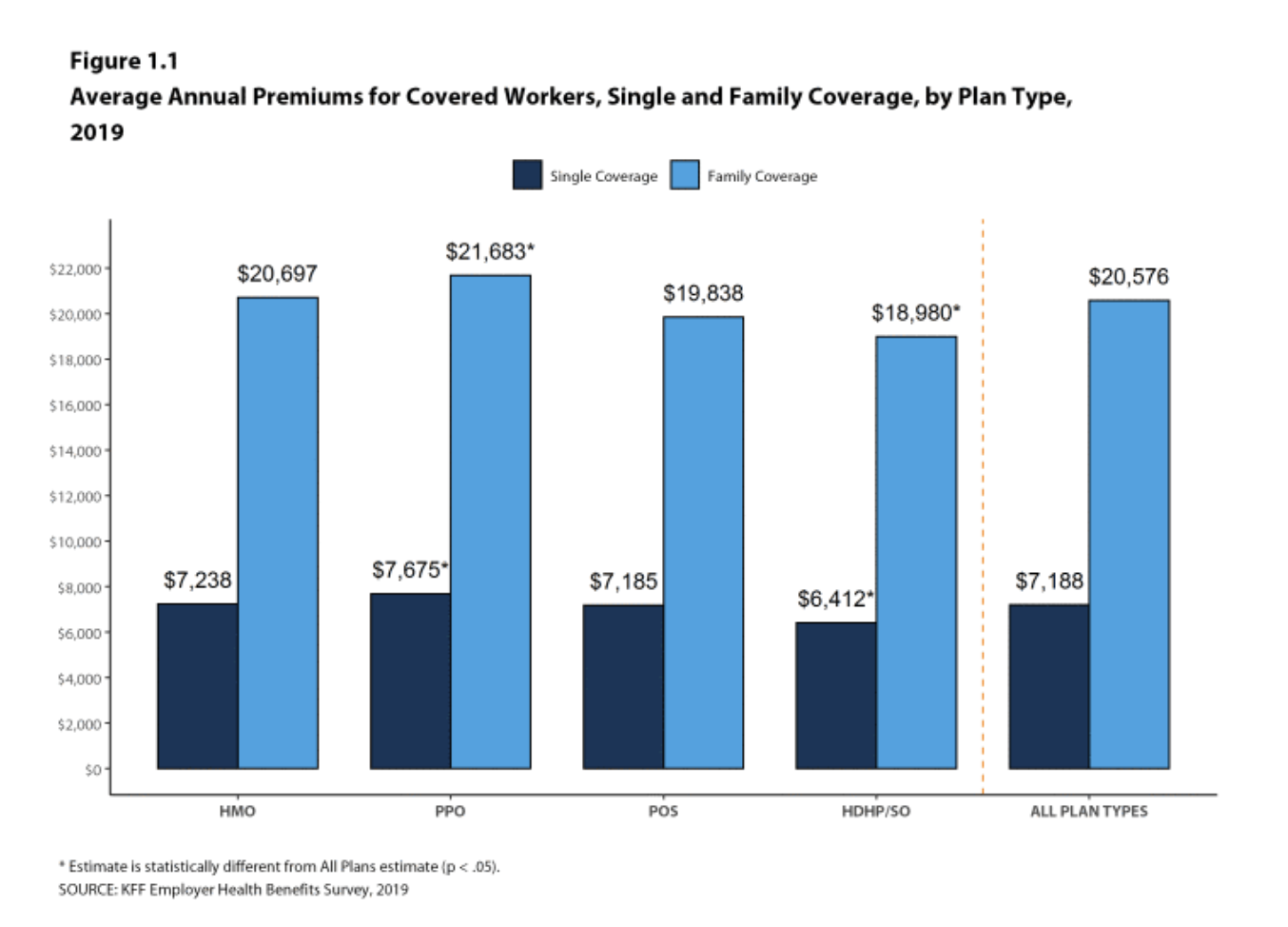

A 2019 survey from the Kaiser Family Foundation found that the average annual premiums are $7,188 for a single person and $20,576 for family coverage.

Small Business Health Options Program (SHOP)

Starting in 2014, small businesses have been able to participate in small business health options programs, often known as SHOP exchanges.

These programs include new state-based health insurance purchasing pools or CO-OPs where small businesses can pool together to purchase group health insurance.

Small businesses are defined as those that have between 5-100 employees.

Some states have created their own State-based Marketplaces for both individual and small business health insurance. The federal government runs the Individual Marketplace through HealthCare.gov and offers a ton of valuable information to get started.

The SHOP law also assists small businesses, and small tax-exempt organizations afford the cost of covering their employees’ health insurance. If your small business has fewer than 25 employees and provides health insurance, it may qualify for a small business tax credit of up to 50 percent (up to 35 percent for non-profits) to help offset insurance costs.

To determine if your business is eligible for the SHOP tax credits, visit the Tax Credit Estimator.

Does a Business Have to Pay 100% of Employees Health Insurance?

Because group health insurance plans are a form of employer-sponsored coverage, a business is required to share the cost of health insurance with employees.

A business does not have to pay the entire cost for health insurance for their employees. An employers’ average health insurance amount is 82% for single coverage and 70% for family coverage.

Typically, this cost-sharing element of health insurance requirements refers to a small business splitting monthly premium costs with their workers.

In most states, employers must contribute or pay for at least 50 percent of each employee’s health insurance premiums, although this depends on the state where the business is located.

If you offer group health insurance coverage to any full-time employee, you must offer it to all full-time employees under the Affordable Care Act. A full-time employee is classified as anyone working 30 or more hours per week.

Although you are not required to, you can also offer health insurance for part-time employees. Part-time employees work an average of 20 to 29 hours per week. If you provide health insurance coverage to one part-time employee, you must offer it to all part-time employees.

Get Help With Your Small Business Health Insurance Plans

Small businesses often pay more for employee health benefits because they don’t have big employers’ buying power.

Most states have laws that require state-licensed health insurance organizations to provide coverage to small employers that request it. They also ensure there are some limitations on the rates that can be charged.

To get a clearer idea of what the costs are for your small business to offer health insurance, you can talk with our team.