If you run a small business and wonder how much small business insurance costs, this article will give you a quick overview.

Of course, every small business is very different. This factor can make it difficult to estimate the small business insurance costs without getting a quote from an insurance agent or insurance broker.

Due to the different aspects that make up small business insurance and the factors determining the actual cost, the insurance premium price can vary widely from one business to the next.

However, as business and commercial insurance brokers, we try our best to give a clear answer to the question, “What is the cost of small business insurance?”

How Much Should I Pay for Small Business Insurance?

The difference between different types of business insurance can be confusing, so it makes sense to reach each type individually.

Each type of small business insurance policy protects against different types of risk, and these differences are factored into the price of the premiums.

The cost of your small business insurance policies is calculated using several fundamental factors.

These factors can include:

- Your profession or trade

- Industry-specific risks

- Number of employees

- Unique coverage needs (e.g., property or vehicles)

You should probably expect to pay more than the average insurance rates if you require more coverage, lease a unique property, or have had a history of claims.

Learning how these different aspects influence your cost can help you secure the best combination of price and protection for your unique situation. Working with an insurance broker can also help you to bundle your insurances and potentially save on premiums.

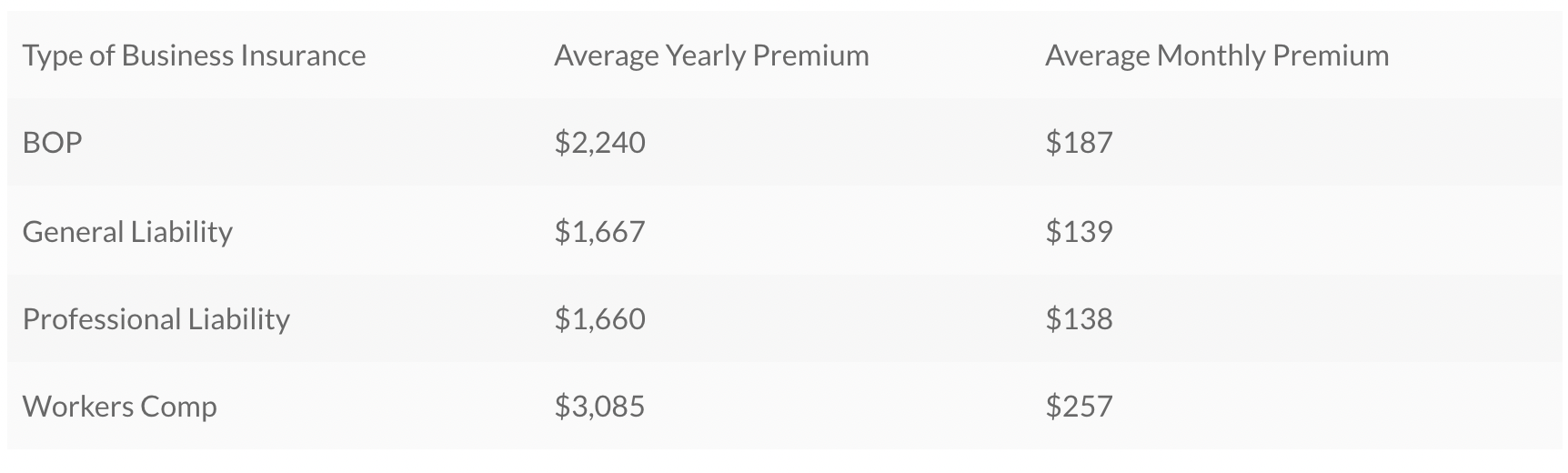

Business Owner’s Policy – Average Cost $187 per month

A Business Owner’s Policy (BOP) will combine business property and business liability insurance into a single business insurance policy. A BOP Insurance policy helps cover your business from claims resulting from fire, theft, or other covered disasters. In addition, this insurance policy cover includes claims of bodily injury or property damage.

Worker’s Compensation – Average Cost $257 per month

Also known as workers comp or disability insurance, this plan covers worker illness or injury.

This type of insurance policy protects your small business employees from lost wages and covers medical costs from an accident or debilitating condition. The policy also protects the employer from being sued for negligence if one of their employees is hurt on the job. Some states, such as California, require workers’ compensation, while other states may not.

General Liability Insurance – Average Cost $139 per month

General liability insurance protects the business owner from claims related to property damage and personal injury. If a customer is injured or their property is damaged while on your premises, this insurance policy will cover the costs of repair, medical expenses, or replacement.

Professional Liability Insurance – Average Cost $138 per month

Professional liability insurance is insurance for specific business owners who are susceptible to claims such as malpractice or negligence. Typical businesses that use professional liability insurance can include attorneys, accountants, consultants, etc.

Get a Personalized Quote for Your Small Business Insurance

These basic costs can act as a guide for what you might expect to pay as a small business owner for insurance. However, keep in mind that some costs can be reduced if bundled, and some types of insurance may not be needed for your specific business.

Working with a business insurance broker can help you get the best value insurance for your small business. They are connected with multiple insurance carriers and have a ton of experience helping small businesses manage their insurance costs.